What Is The Coupon Rate Of A Zero Coupon Bond . A bond's coupon rate is the percentage of its face value payable as interest each year. And that’s ultimately because for the most part, zero coupon bonds. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. It is also called a pure discount bond or deep discount bond. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. A bond with a coupon rate of zero,. Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face.

from www.slideserve.com

And that’s ultimately because for the most part, zero coupon bonds. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero,. Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. It is also called a pure discount bond or deep discount bond. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds.

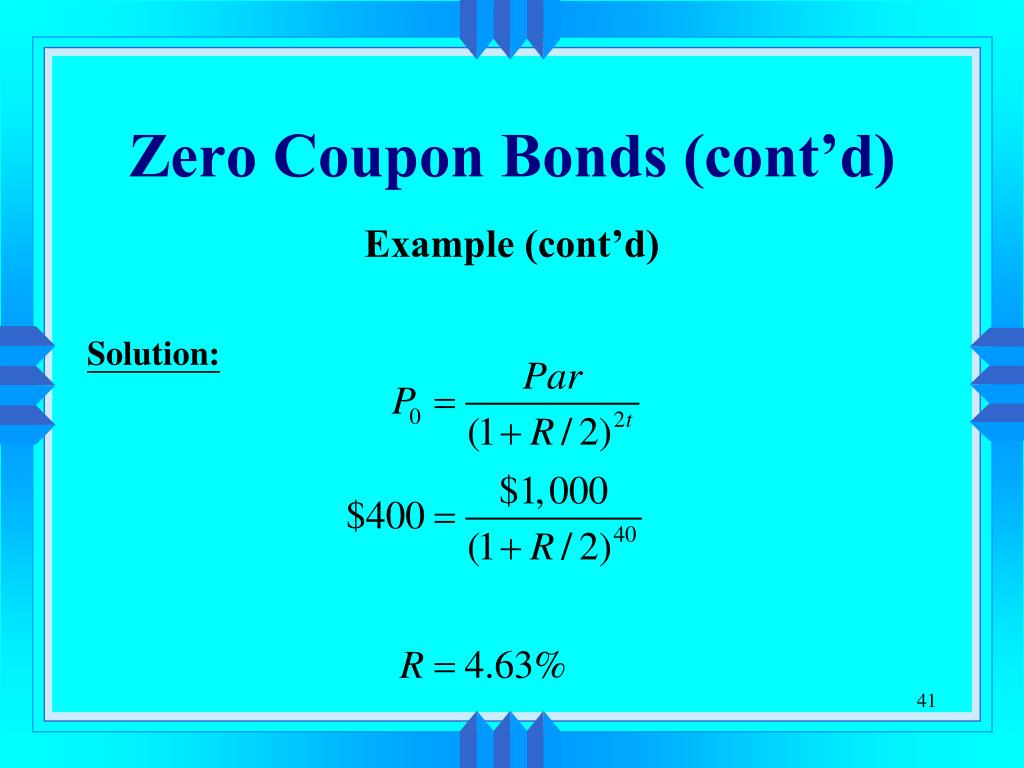

PPT Chapter 12 Bond Prices and the Importance of Duration PowerPoint

What Is The Coupon Rate Of A Zero Coupon Bond A bond with a coupon rate of zero,. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. And that’s ultimately because for the most part, zero coupon bonds. It is also called a pure discount bond or deep discount bond. A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero,. Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds.

From seekingalpha.com

U.S. Treasury Zero Coupon Bond Yields And Forward Rates, October 17 What Is The Coupon Rate Of A Zero Coupon Bond With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. And that’s ultimately because for the most part, zero coupon bonds. Investors earn a return from zeros because they buy the bond at a discount to face value. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.chegg.com

Solved Prices of zerocoupon bonds reveal the following What Is The Coupon Rate Of A Zero Coupon Bond And that’s ultimately because for the most part, zero coupon bonds. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. A bond's coupon rate is the percentage of its face value payable as interest each year. The. What Is The Coupon Rate Of A Zero Coupon Bond.

From marketbusinessnews.com

Coupon rate definition and meaning Market Business News What Is The Coupon Rate Of A Zero Coupon Bond The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. And that’s ultimately because for. What Is The Coupon Rate Of A Zero Coupon Bond.

From quantrl.com

Zero Coupon Bond Yield Curve Quant RL What Is The Coupon Rate Of A Zero Coupon Bond With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. It is also called a. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.youtube.com

Zero Coupon Bond Valuation using Excel YouTube What Is The Coupon Rate Of A Zero Coupon Bond A bond with a coupon rate of zero,. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. And that’s ultimately because for the. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.chegg.com

Solved You find a zero coupon bond with a par value of What Is The Coupon Rate Of A Zero Coupon Bond It is also called a pure discount bond or deep discount bond. A bond with a coupon rate of zero,. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. Investors earn a return from zeros because they buy the bond at a discount to face value. What Is The Coupon Rate Of A Zero Coupon Bond.

From ppt-online.org

Valuing bonds. (Lecture 6) презентация онлайн What Is The Coupon Rate Of A Zero Coupon Bond The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. Investors earn a return from. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.slideserve.com

PPT Interest Rates and Bond Valuation PowerPoint Presentation, free What Is The Coupon Rate Of A Zero Coupon Bond It is also called a pure discount bond or deep discount bond. A bond with a coupon rate of zero,. Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.slideserve.com

PPT Chapter 12 Bond Prices and the Importance of Duration PowerPoint What Is The Coupon Rate Of A Zero Coupon Bond With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. It is also called a pure discount bond or deep discount bond. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest. What Is The Coupon Rate Of A Zero Coupon Bond.

From accountantskills.com

ZeroCoupon Bond Definition, Formula, Example etc. Accountant Skills What Is The Coupon Rate Of A Zero Coupon Bond With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. A bond's coupon rate is the percentage of its face value payable as interest each year. And that’s ultimately because for the most part, zero coupon bonds. Investors. What Is The Coupon Rate Of A Zero Coupon Bond.

From fortunez.com

What is a ZeroCoupon Bond? Definition and Meaning FortuneZ What Is The Coupon Rate Of A Zero Coupon Bond With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. A bond with a coupon rate of zero,. Investors earn a return from zeros because they buy the bond at a discount to face value and then are. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.youtube.com

How to Calculate the Rate of Return on a Coupon Bond YouTube What Is The Coupon Rate Of A Zero Coupon Bond A bond with a coupon rate of zero,. It is also called a pure discount bond or deep discount bond. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. The interest rate (aka yield) of zero coupon. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.researchgate.net

1 Zero coupon bond prices, spot and forward interest rates, and spot What Is The Coupon Rate Of A Zero Coupon Bond Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. And that’s ultimately because for the most part, zero coupon bonds. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. It is also. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.researchgate.net

Trading zerocoupon bond with maturity T = 5 years. Average unimpacted What Is The Coupon Rate Of A Zero Coupon Bond It is also called a pure discount bond or deep discount bond. Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. A bond with a coupon rate of zero,. A bond's coupon rate is the percentage of its face value payable as interest each year. The. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.chegg.com

Solved You find a zero coupon bond with a par value of What Is The Coupon Rate Of A Zero Coupon Bond A bond's coupon rate is the percentage of its face value payable as interest each year. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. It is also called a pure discount bond or deep discount bond.. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.indiabonds.com

ZeroCoupon Bonds Definition, Pricing, and Benefits IndiaBonds What Is The Coupon Rate Of A Zero Coupon Bond Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. And that’s ultimately because for the most part, zero coupon bonds. A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero,. It is. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.wallstreetprep.com

ZeroCoupon Bonds Characteristics and Calculation Example What Is The Coupon Rate Of A Zero Coupon Bond The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. A bond with a coupon rate of zero,. With a zero, instead of getting. What Is The Coupon Rate Of A Zero Coupon Bond.

From www.investopedia.com

ZeroCoupon Bond Definition, How It Works, and How to Calculate What Is The Coupon Rate Of A Zero Coupon Bond Investors earn a return from zeros because they buy the bond at a discount to face value and then are paid the face. A bond with a coupon rate of zero,. And that’s ultimately because for the most part, zero coupon bonds. The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of. What Is The Coupon Rate Of A Zero Coupon Bond.